The Focus of Our Work

A Coordinated "Team" Approach to Assist in the CREATION, MANAGEMENT and PRESERVATION of WEALTH.

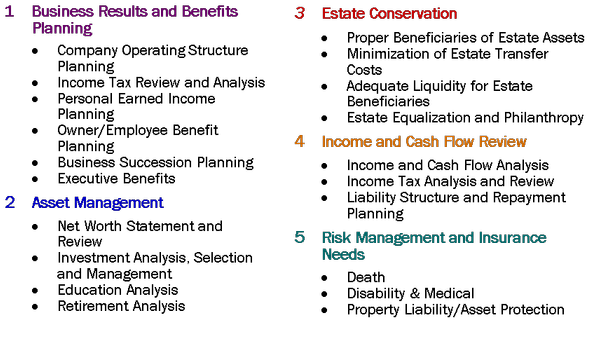

Business Results and Benefits Planning

There are a number of issues that business owners face, including providing employee benefits, obtaining business insurance and transferring the business upon death, disability or retirement. For most small business owners, their business lives and personal lives are inseparable. The financial planning process helps business owners to manage both business concerns and personal concerns so that they can achieve all of their goals and dreams.

A personalized financial plan can help you, the small business owner, address concerns such as:

Protecting your business assets

Ensuring the continuation and succession of your business

Promoting, recruiting, retaining, and rewarding your key employees

Maximizing your compensation benefits

Providing for estate equalization

Promoting family harmony

Retirement Planning

The amount you will need in retirement depends upon a number of variables, including the age you plan to retire, your desired retirement lifestyle, how long you expect to live, and the rate of return that you expect to earn on your investments. Social Security and employer-sponsored pension plans will likely provide a smaller percentage of your retirement income than they provided for your parents' retirement income.

One or more of the following strategies could help you to maximize your retirement income:

Retiring at a later age

Saving more before retirement

Spending less during retirement

Investing to earn a potentially higher rate of return on investments while still feeling comfortable with the level of risk involved

An adviser can help you determine which strategies make the most sense given your retirement objectives.

Education Planning

Education planning for your children can be a major financial consideration. Planning early allows you to take advantage of the time value of money and help minimize the savings requirement.

Consideration should be given to one or more of the following strategies when trying to maximize your college planning:

Prioritizing your education objective with your insurance needs, retirement needs, major purchases and current income needs

Developing an effective savings strategy that considers asset allocation and takes advantage of education plans

Considering the various education funding accounts -- Qualified State Tuition Plans (also known as 529 Plans#), Uniform Transfer to Minor Accounts (UTMA) / Uniform Gifts to Minor Accounts (UGMA), Coverdell Educational savings accounts and prepaid tuition plans

Ensuring college expenses are realistically calculated and include tuition, room and board and living expenses. There are many factors to consider such as the inflation rate for the rising cost of tuition, whether your child will attend post-graduate studies and whether your is likely to receive scholarships or financial aid.

Investment Planning

You can now receive the same portfolio management services as many institutional investors-whether it is a separately managed account or a mutual fund wrap portfolio.

Some benefits of managed portfolios include:

Providing access to top-tier investment management professionals

Tailored portfolios to meet specific investment needs

Ownership of individual securities

Ease of pre-designed mutual fund portfolios

Every investor is unique, and investment advisory services provide you with professional investment advice and a personalized investment strategy. Whether you're seeking a tailored, professionally managed portfolio, or the convenience and simplicity of a diversified mutual fund wrap program, your investment choice should focus on meeting your financial goals. During this process, you should consider current and future growth objectives, income needs, time horizon and risk tolerance. These considerations form the blueprint for developing a portfolio management strategy. The process involves, but is not limited to, the following important stages.

Set investment objectives

Develop an asset allocation strategy

Evaluate/Select investment vehicle

Portfolio review -- Ongoing portfolio monitoring

#Securities offered through NYLIFE Securities LLC. (member FINRA/SIPC).

*Neither Jungen & Co. Financial Advisers, Eagle Strategies LLC nor any of its affiliates provide legal, tax or accounting advice. Please contact your own advisors for more information on your particular situation.

Estate Conservation

What you value may be more important than what you own. To follow through on your commitments -- to yourself, your family, and your ideals -- you need to think ahead. A personalized estate plan is important in helping to protect your family and your legacy.

A well-constructed strategy can help address your specific estate planning needs including:

Minimizing income and estate taxes

Transferring wealth from one generation to the next

Developing charitable gifting strategies

Aligning existing portfolios and retirement accounts with your estate plan

Risk Management and Insurance Needs

A sound financial plan must address the insurance coverages you, your spouse and family members may require.

Life insurance is used to pay for funeral expenses, repay outstanding debts, make charitable donations and provide living expenses for surviving family members. It can also be used to cover estate taxes and probate fees to enable your estate to be liquidated in the most appropriate manner.

Disability income insurance is to help partially replace income of persons who are unable to work because of sickness or accident. In terms of its financial effect on the family, long-term disability can be just as severe as death. Disability income protection can come from several sources: social insurance programs, employer-provided benefits, and individually purchased policies.

Managing Costs for Extended Periods of Care To execute a sound retirement strategy, asset and income protection are a must. Designing a plan that encompasses managing costs for extended periods of care.

Annuities can be an integral part of a retirement income strategy. For retirees, one of the biggest concerns is outliving their assets. WIth advances in medical technology, people are living longer than ever. At the same time, interest rates are much lower today then they have been in recent years making fixed income investing less attractive than it once was. In turn, equity markets are inherently volatile and not necessarily well suited for generating reliable sources on income. A lifetime income annuity can provide a steady stream of income that connaot be out lived- helping to insure against outliving ones assets. Through the use of mortality credits and the concept of risk pooling, the risk of living to long is shifted to the insurance company.

Click Here To Learn More About the Holistic Planning Process

Click Here to Learn More About Risk Aware Investing.

§Products available through one or more carriers not affiliated with New York Life, dependent on carrier authorization and product availability in your state or locality.